- +91 7503020114/15/16/17

-

"AMFI-registerd Mutual Fund Distributor"

"AMFI-registerd Mutual Fund Distributor"

Founded in 2003, Gera Wealth Pvt. Ltd. (GWPL) is an AMFI Registered Mutual Fund Distributor with over 22 years of experience in helping clients plan and achieve their financial goals.

We provide a one-stop platform for investment solutions across Mutual Funds, Bonds, Non-Convertible Debentures (NCDs), Market-Linked Debentures (MLDs), along with protection solutions including Life Insurance, Health Insurance (including Critical Illness cover), Personal Accident, Vehicle, Home, Shopkeeper, and Director Liability Insurance.

At GWPL, our endeavor is to assist clients in their financial freedom journey through a structured and time-tested process. Over the years, we’ve grown alongside our clients, and today we are privileged to assist the second generation of families in designing their financial roadmaps.

We believe onboarding a client is like an Indian wedding – a lifelong partnership where we stay committed to their financial well-being at every stage.

To Educate, Empower & Inspire people to live with Financial Freedom.

Happiness for all through Financial Literacy.

Creating Wealth by Managing it Wisely.

Founded in 2003, Gera Wealth Pvt. Ltd. is a boutique wealth management firm and AMFI-registered Mutual Fund Distributor. For over 22 years, we have been guiding individuals, families, and businesses towards financial freedom through disciplined investing, risk management, and personalized financial solutions.

We provide a one-stop solution for investments and protection:

Our goal is to create tailored strategies that match each client’s goals, needs, and risk profile.

We believe every financial journey is unique. That’s why we follow a structured, time-tested process:

We treat client onboarding like an Indian wedding – a lifelong commitment to your financial well-being.

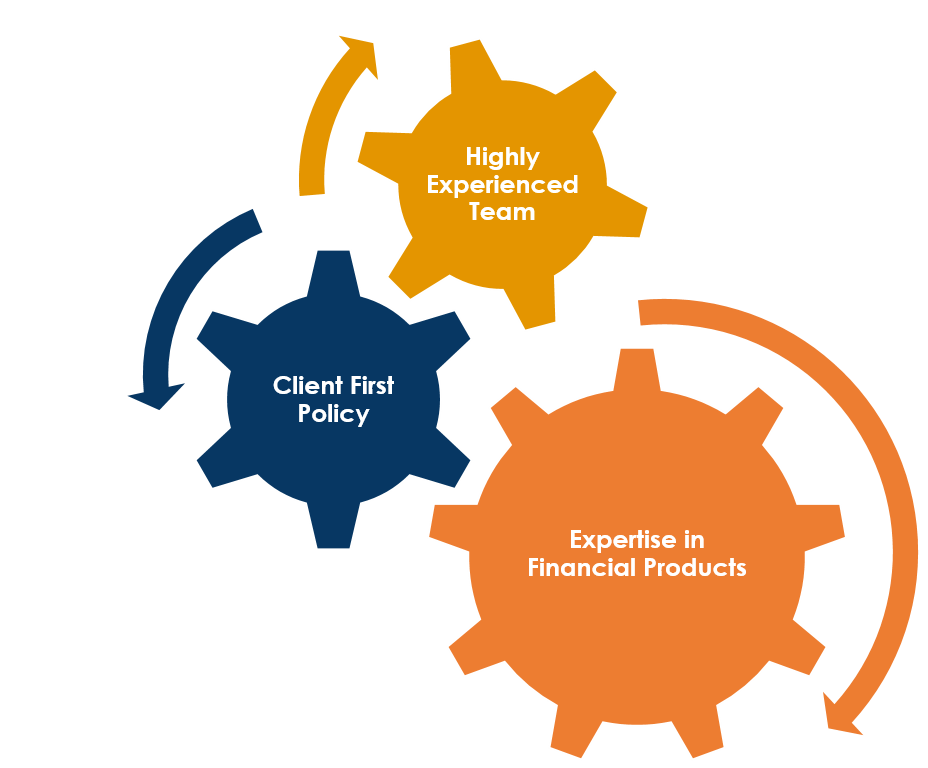

✅ 22+ years of experience in wealth management

✅ Client-first approach – we grow only when you grow

✅ Serving not just our clients, but now also the second generation of their families in their financial freedom journey

✅ Holistic financial solutions under one roof

✅ Transparent, process-driven, and research-backed advice

✅ Long-term partnership mindset

© 2020 Gera Wealth Pvt. Ltd. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

AMFI Registered Mutual Fund Distributor | ARN-147697 | Date of initial Registration: 12th June 2018 | Current validity of ARN: 11th June 2027.

SIF EUIN Code : E13838

Important Links | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors